President Trump Returns from New Jersey More: President Donald J. Trump waves Sunday, July 7, 2019, as he prepares to board Air Force One at the Morristown Municipal Airport in Morristown, N.J., for his return to Washington, D.C. (Official White House Photo by Shealah Craighead). Original public domain image from <a href="https://www.flickr.com/photos/whitehouse45/48233665381/" target="_blank" rel="noopener noreferrer nofollow">Flickr</a>

The Turnabouts of Tariffs

Tariff—overnight, this word gained popularity and raised a mountain of opinions worldwide. This word flashes on every news channel, makes businesses wary, consumers angry, and countries unsure of established foreign relations. But why? What significance can one word hold?

What’s all the talk about?

Tariffs are taxes imposed on imported goods into a country, often to protect national businesses and raise domestic revenue and therefore promote economic growth and independence.

By no means is this system new; in fact, many precedents can be seen from U.S. presidents. Some examples include George Washington setting a 5% tariff rate on most imported goods in 1789; the Smoot-Hawley Act of 1930 by Herbert Hoover seeking to prevent foreign competition; and, more recently, the Biden Administration setting a tariff on semiconductors. However, as explained by Ann Pember, a World History and Psychology teacher at Malden High, this act resulted in “economic collapses” during the Great Depression.

While on the surface level, the concept seems beneficial, further inspection and analysis leads to our understanding that tariffs have a multilateral effect on our country’s economy, international trade, and consumers and buyers—all of which may not be positive.

Another factor to consider is that the rate at which the Trump Administration is imposing tariffs is unlike any precedent seen before; hence, the outcomes and the impacts of their legislation will be harder to predict. This is important to note because businesses that are unsure of how the market will be affected are hesitant about what decisions to make to earn a profit. If businesses are forced to purchase goods in demand at a higher price, then they, in turn, will make the product expensive leading to unaffordability of simple items.

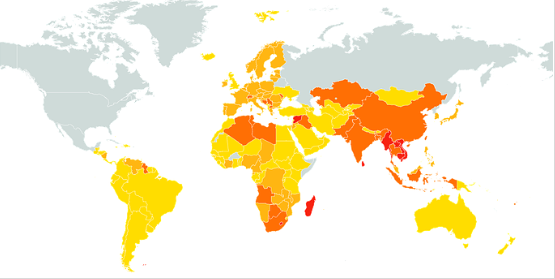

Furthermore, the imposed tariffs are not appreciated by foreign countries, and since they, too, have the power to tax the U.S., many have placed high retaliatory tariffs on us, hindering the U.S.’s economic growth in the global market. Several worry that the continuation of this system may eventually lead to a recession, severely affecting American lives.

A Quick Run Down

- January 20 – President Donald Trump enters into his second presidency and immediately signs a series of “historic” tariffs, influencing nearly all goods flowing into the country; his reasoning was for countries to understand the consequences of illegal immigration and drug trafficking—specifically fentanyl, but he also supports independent manufacturing and reducing trade deficit, believing it would, “enrich our citizens.”

- February 1 – Declares “national emergency” and imposes 25% tariffs on Canada and Mexico, and 10% on Chinese goods; however, Canadian and Mexican tariffs are suspended due to the United States-Mexico-Canada Agreement of 2020 (USMCA).

- February 13 – Threatens to impose retaliatory tariffs on countries with trade restrictions/barriers against the US. Trade barriers include unfair tax policies, tariffs, currency manipulation—bending currency to make exports cheaper but imports expensive—import deposits, and quotas that would disadvantage America’s trade; however, the administration was/is open to negotiation.

- March 12 – A 25% tariff on aluminium and steel worldwide, even to those previously exempted in 2018 (Argentina, Australia, Brazil, Canada, Japan, Mexico, South Korea, the EU, Ukraine, and the UK). According to the Trump Administration, the exemptions on these countries “inadvertently created loopholes that were exploited by China.”

- April 2 – Trump announces “Liberation Day”, setting a baseline 10% tariff on nearly all US imports.

- April 9 – After mayhem in the stock market, and tariffs dwindling between 11% to 50% between 57 trading partners, all are suspended for 90 days “except in China.” On the same day, clashes between the US and China raised tariffs on Chinese imports to 145%, and China retaliated by imposing a 125% tariff on the US.

- May 6 – The first cargo arriving from China had shipments cut in half after the 145% tariff, showing a preview of the effects this system will have on America’s economy.

- May 12 – The US and China negotiate and agree to “roll back tariffs” to 30% on Chinese goods and 10% on American goods.

Liberation Day and Global Trade

On April 2nd, President Donald Trump held a conference in the White House Rose Garden to announce “Liberation Day”, describing it as America’s day of “economic independence.” The concept of this proposal is driven by two factors: overcoming trade barriers and raising revenue. For many decades, some countries have had pushback on US goods, and tariffs were meant to be a way to reverse that effect.

However, by imposing tariffs on a country, a trade war can easily start, as seen with China. The opposing country may implement high retaliatory tariffs, which would disadvantage the US. Instead of promoting economic growth, an awkward pause is experienced with a stagnant economy, while we wait for the tariffs to sway the scale. Also, countries that might want to “establish new trades and businesses with the US” are likely to be dissuaded due to these orders, proposed Michael Lightbody, who teaches US History and Foundations of Law.

On the other hand, tariffs encourage Americans to support in-country manufacturing rather than imports, lowering our rate of interdependency. In-country manufacturing would create new job opportunities for people, as new companies are made and raise revenue, although AP Economics and History teacher James Hill argues no significant revenues would be collected, as most comes from “income taxes”—supporting steps toward independence. In cases of a global trade war, America would be less likely to be affected as major goods would be produced within the country, allowing us to thrive.

The issue arises in the process of manufacturing, one may have the means to build a good, but not the parts. For instance, major car companies are located outside of our country, and if we decided to build cars, we would have to import the parts, defeating the point of sovereignty. To completely achieve this goal, America would have to create a system from scratch, to avoid any imports, initially acting “counterproductively”, as stated by freshman Anya Grzegorsewski. Besides, the want to bring back manufacturing jobs to the US is not necessarily “profitable or a road to prosperity”—although offering employment, as, putting it quite frankly, it is cheaper to manufacture goods overseas, where labor is cheaper than in our country, added Hill.

Despite this, one has to understand that an isolationist ideology is not beneficial in the long run. If we were able to create and limit manufacturing within the US, it would ultimately cut off all foreign relationships regarding trade that have been upheld for decades, some even centuries. Not only would this dismantle international trade, but decrease America’s allies for the future. “The idea of making the US an independent country is flawed, because a lot of the material we have cannot be made in the US,” expressed junior Liam Gallagher.

Businesses

Businesses that are heavily reliant on imported goods, especially small cultural businesses, will take a toll, as purchasing prices for them will increase as well. The first wave is usually met with hesitation, and companies wait to see how the order will take effect, often delaying shipments. Hill describes tariffs as “ever-changing,” and businesses align their decisions accordingly, wanting to make their purchase at the lowest possible price.

However, if by the second wave, conditions have not changed and tariffs are only rising, for instance, with China before May 12, companies will be forced to purchase the overpriced goods, in order to avoid even higher costs. Lightbody reiterated, “Since the businesses were compelled to spend extra, to earn profit and meet their needs and goals, they will bump up the shelf prices for consumers.”

Local businesses, who have little to no connection with imported goods, will not notice any differences; instead will receive increased attention due to their prices being cheaper than businesses with imported goods. In that sense, domestic industries will thrive, promoting self-sustainability in our market. Yet, most commerce has some aspect connected to foreign trade. ELA teacher Anne Mooney highlighted, “large companies such as Walmart and Amazon can afford these changes, but smaller businesses cannot, and consumers will be unwilling to purchase from them when they can find the same product for a cheaper price elsewhere.”

Before May 12, economists worried about what stores would look like around the holiday season, especially Christmas. If the negotiations between the US and China were not successful, toy prices would surge, and many families would not have been able to afford a present for their children. Most toys that come into our country are produced in China, therefore, the high tariff rates would have directly impacted the toy section. Thankfully, negotiations lowered tariffs from 145% to 30%, which is still pricey, but significantly better than before.

Civilian Impact

Any economic change made in the country will directly affect citizens, either for the better or worse. With tariffs, people will not immediately be able to feel the impact of tariffs, as it takes “3-4 weeks for container ships” to reach the US, and although imports have shrunk, a “widespread shortage of goods” could be expected by June or the holiday season, Hill believes. As explained in the previous section, businesses purchasing goods at a higher price will only raise prices for consumers, as companies have to earn a profit. This severely inconveniences Americans and small businesses, because more dollars will be spent out of their pockets. Monthly costs will increase, and basic amenities will become unaffordable.

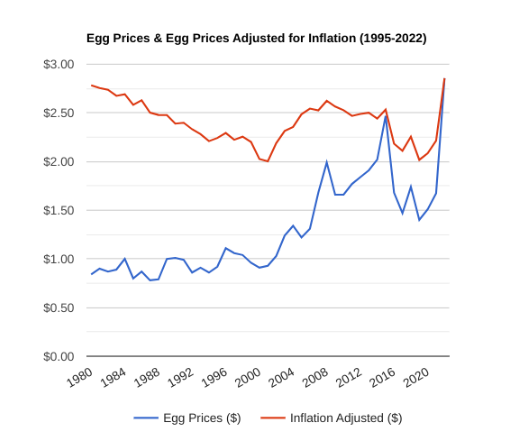

Inflation has already raised prices—just look at egg prices. In 2019, a dozen eggs on average cost $1.51, and by 2025, we have seen a 311.92 % increase to $6.22. Simple household items begin to become “luxuries”—rising twice or thrice in price, and tariffs will only “exacerbate” these expenditures, elaborated Mooney. The tax bracket most impacted by these executive orders will be the lower and middle class families, who are already toiling to reach ends meet. It ends up “targeting those who are financially unstable and rendering the poor poorer,” voiced freshman Aya Bihi.

Employees are prone to receive lower wages if a business is suffering, creating a double-edged sword: low salaries and high prices. Instead of promoting economic growth, people’s pockets will become tighter, and poverty will only increase in the country.

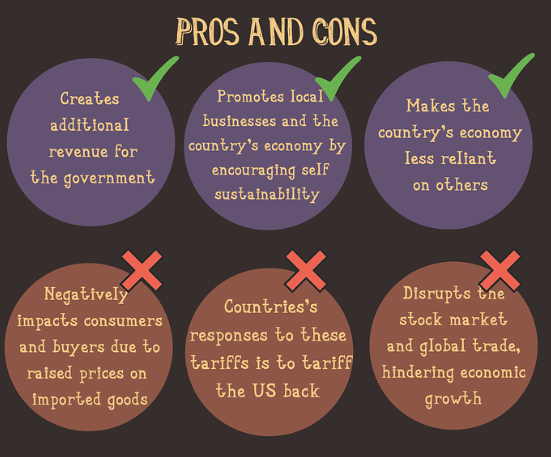

Pros and Cons

The following boils all these factors into concise points: