Cover photo: Waitt Brick Block, Malden Massachusetts. Wikimedia Commons JOHN PHELAN

Fatima Husain also contributed to this article.

While many outlets mingle together in a student’s academic life, school is the core foundation of it all. But what fuels schools’ ability to provide adequate resources for students? Dive deep to learn more about Malden’s funding, our high school, and its impacts.

Impacts

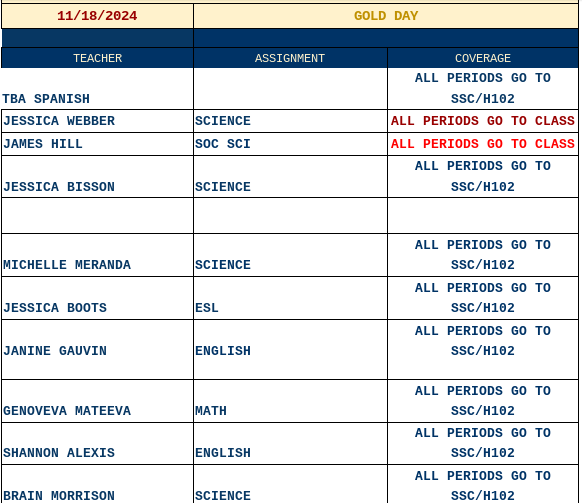

In 2023, 41.3% ($82,133,859) of the annual budget was set aside for the Education Department, and $12,773,075 was allocated to Malden High School. Similarly, for the 2024-2025 School Year, MHS got $15,868,605. The numbers seem so grand while reading about it, but then students sit in school and wonder where all that money went. Students continue to deal with TBA (to be announced) classes, a lack of substitute teachers, hours spent in the Student Study Center (SSC) and directed studies, and $68 fees for AP exams due to depleted COVID funding.

“Most vacancies we have, unfortunately, tend to more adversely impact students with disabilities and students who are learning English because those are licensure areas (Special Education and English as a Second Language) in which we have difficulty recruiting teachers for those roles. And this is the case in many districts, not just Malden,” Dr. Timothy Sippel, the Superintendent of Malden Public Schools, acknowledged.

These factors disrupt students’ learning flow and gradually affect their academics and school environments. Students enrolled in TBA classes or directed studies do not have designated education for the semester or year and will be increasingly behind in the syllabus if a teacher is hired, compared to the same class with a different teacher.

This can directly impact grades, pressure from the class, and credits needed to graduate. Students, especially those who have had a TBA class or directed study since August 28th, are reportedly frustrated by spending 80 minutes in SSC or in directed study every alternate day and question why a class was even available for them to take when a teacher was not hired for it.

“The idea of SSC on paper sounds fun, like, ‘Oh my god, a free block!’ but when you start thinking about it, you’re missing out on learning and time you can be productive. People tell me I’m lucky to have a TBA class, but I don’t want to waste my time,” explained freshman Sabrima Bhattarai.

Adding to Bhattarai’s argument, freshman Edythe Howse, enrolled in TBA Spanish, mentioned, “I want a Spanish teacher. It’s that simple… I just don’t want to waste my time.”

Combined with the teacher shortage is a lack of substitute teachers—without a substitute, students with absent teachers spend the period in SSC or the cafeteria.

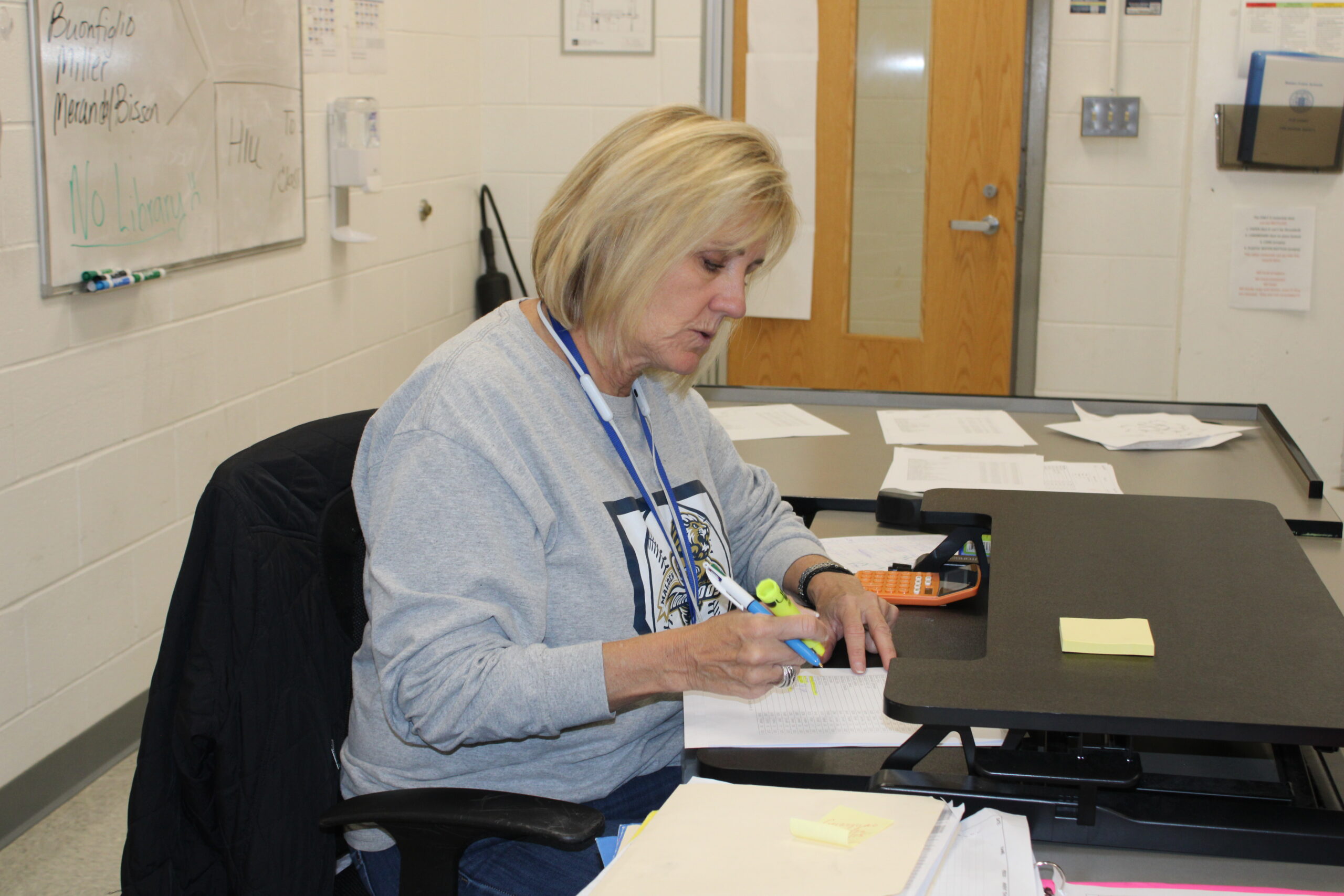

Karen Bogan, the Student Study Center’s regulator, pointed out the benefits of SSC: “I think it can be a pro to catch up on your work and finish it. If you have work after school, you take care of your younger siblings, or you’re on a sports team, it’s nice to get it done.”

At the same time, Bogan acknowledged several flaws in the system. “Some students come to SSC and are very disruptive…I would say the con is having a student in here who doesn’t want to be in here and is trying to get out.” She noted that some students get a temporary pass but never return, walk out early, or do not show up. Doing this, however, “is an absence from class,” which could eventually impact grades to the extent of failing.

“Most of the time SSC gets full and loud, so often kids aren’t able to focus and do work, only 10-15 students are allowed to get a pass to the library, so the remaining students aren’t able to focus on their work,” detailed sophomore Gloria Alexis.

Bogan expounded her irritation at students coming to SSC for an absent teacher and then being told to relocate to Cafe A or the Gallery due to a confusion with absent teacher list email posted daily. She sympathizes with students who have to walk down to the SSC room on Holland’s First Floor from anywhere in the building, only to be told to shift to another location, making them inevitably late.

Senior Class President Christina Anasthal emphasized, “The lack of teachers and classes at Malden High made it harder for me to find my interests. Whenever I wanted to fill my schedule with more classes that catered to my interests, like Biotech or Applied Health Sciences, it’d be hard with scheduling or coverage issues.” Like many other students, Anasthal was pushed to the last resort: “Instead of letting an empty period go to waste for a credit, I would fill it with a Student-to-Career.”

“The lack of teachers and classes has affected the students’ academics and their education, as they aren’t able to get into the classes that they may want or need to take for their major if they decide to go to college. It gets upsetting when classes are full and you end up losing potential credits which can set you back for graduation and college,” added junior Haylee Seeley.

Where does it come from? Where does it go?

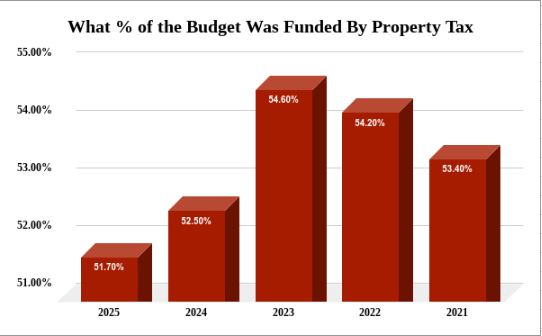

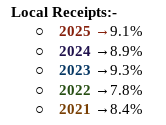

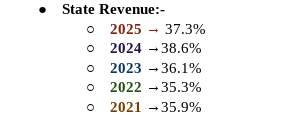

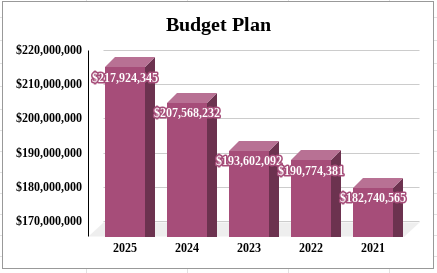

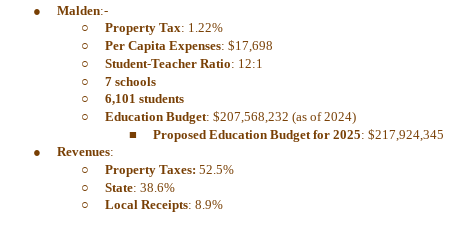

School funding is part of the city’s yearly budget, which is composed by the Executive Branch of Malden and approved by the city council. The city’s budget is derived from four main sources: property taxes; local receipts, which are revenues generated by the local government, excluding property taxes and state aid; state revenues; and federal grants. The amount received from each source differs each year.

Property Taxes

The simple definition of a property tax is a tax imposed by federal, state, or local governments based on the value of an individual’s property. This means homeowners and business owners have to pay a certain tax regarding the ownership of their property. The tax collected is then used to cover public services such as schooling, firehouses, police departments, and public safety.

An issue thus arises that the high prices of housing combined with high poverty rates in Malden results in low revenue from property taxes, cumulatively impacting the budget accumulated for public services, including schooling. Furthermore, this matter is not easily resolvable—many aspects play a role in creating a hurdle when raising property taxes in poorer communities, including Malden.

- Lower Revenue Potential: High-poverty areas often have lower property values, limiting the revenue generated from property taxes even with high rates.

- Increased Financial Burden: Property taxes unreasonably impact low-income residents, potentially leading to financial hardship and propelling residents to leave the area.

- Political and Social Challenges: Raising property taxes can be politically and socially difficult, especially in areas with limited resources and services, possibly leading to community discontent.

“We believe that a lot of the property owners, if faced with a higher tax bill, are just going to send that down to the people that they’re renting to. And we believe those families are having a tough time as it is today, so to ask them to do more would be unfair,” Mayor Christenson expressed.

According to Malden, Massachusetts Property Taxes – Ownwell, Massachusetts has a tax threshold for property taxes starting at 1.23%, which means any county, town, or city exceeding that limit will gain extra funding from the state. Malden’s property tax percentage lies just a smidge away from the state’s threshold at 1.22%. Raising the tax by 0.01% would allow Malden to obtain that extra boost from the state for our city to prosper.

No one likes taxes, so it is understandable that the residents of Malden, especially homeowners and small business owners, would not want their property tax to rise. Inflation has made spending tight enough, and increasing taxes would not benefit property owners or their renters. However, if the property tax were to increase, it could have immediate and severe benefits for students and those avidly working in the community.

This is where Proposition 2 ½ would become an obstacle: the Proposition states that a town in Massachusetts cannot levy more than 2.5 percent of the total full and fair cash value of all taxable real and personal property in the community, which could potentially halt an increase in property taxes for the district. Additionally, Malden meets the 2.5 levy amount each year, meaning that we do not falter at collecting property taxes, but neither can we surpass it.

“Proposition 2 ½ was enacted back in the 1980s and it’s a state law. So in order for us to change that, we would have to go to the voters of Malden,” Christenson explained. “We have not done that… and that’s a result of a few things. One is we’ve been able to keep up with net school spending here in Malden, so we are in compliance with the law that we meet what is required of us to spend on education.”

State Revenue, Federal Grants, and Local Receipts

Each year, the state government grants Malden a designated portion of revenue—income, specifically received from taxes—to be used while composing the budget plan for the year.

Massachusetts is responsible for ensuring and providing the necessary means for its students to excel in and outside of school. This is guaranteed by the Chapter 70 program, which is a major agenda administering state aid to public elementary and secondary schools. In contrast, Jason Lewis, a Senate member of Massachusetts, has been continuously fighting to change policies on the program to ensure every city in the state earns a fair chance at education with bill S.304. To read more about it visit: Bill S.304

Meanwhile, as mentioned previously, local receipts exclude state grants and property taxes and include, but are not limited to, fees, fines, excise taxes (a tax on the sales of a good or service), and licenses. While local receipts do not make up a large percentage of the budget, they are an important part of our community and are necessary for Malden to prosper. Without them, it is possible that our city would not meet certain aspects as it does today.

From Federal Grant Programs – Massachusetts Department of Elementary and Secondary Education, it can be comprehended that the federal government provides our last major grant and it primarily goes to the Special Education Department, allowing the department to meet its requirements. The Individuals with Disabilities Education Act (IDEA) of 2004 and the Every Student Succeeds Act (ESSA) of 2015 ensure the department obtains the required funds.

Adding up all the funding gathered from these four sources, the total proposed budget for 2025 comes out to be $217,924,345, and the years before that had similar results.

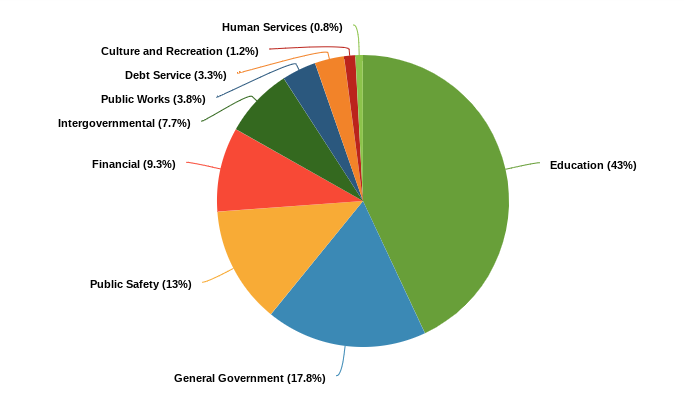

Naturally, when analyzing the values of the millions allocated to our city, we wonder where the money is distributed. The budget is directed to nine locations: Human Services, Culture and Recreation, Debt Service, Public Works, Intergovernmental, Financial, Public Safety, General Government, and Education. Out of these nine categories, Education receives the highest amount of funds, yet the schools still struggle to meet the needs of students, specifically regarding the teacher shortage.

Chapter 70

The aforementioned Chapter 70 is a state aid program for all the Education Departments in Massachusetts, which translates to money for schools from the state. However, a significant problem with the program is the way it distributes yearly funds to cities.

Christenson explained that, despite rigid data available for each city, the state estimates per-pupil expenses and according to that information provides funds. Concrete and detailed facts for each city’s finances can be found on their official websites, requiring no need for “estimations” and does not account for commercial businesses, additional revenues, or federal grants.

Furthermore, by not calculating the funds a city acquires besides state aid, wealthy towns will continue to become wealthier, and struggling communities will not receive the necessary boost.

“We’re trying to get the state to take a look at that [the inequity]. We’ve met with the commissioner of education, we’ve met with our state delegation…[because] the formula is looking down and saying, Well, your values are good, so you don’t need as much from us [the state], when, in actuality, though, we have 30-40% [of our population] that can barely make ends meet. So although the formula [Chapter 70] says one thing, what’s happening here on the ground is different,” Christenson continued.

Screenshotted off of doe.mass.edu

Comparison Between Cities

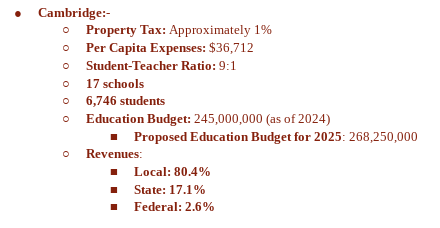

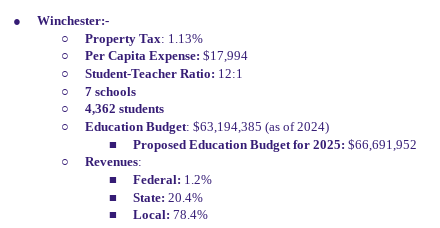

It can be argued that the teacher shortage is a nationwide or statewide problem. Yet, neighboring cities such as Cambridge and Winchester thrive compared to Malden even though per capita expenses for students are proportionately within the same range.

If a student who resides in Malden goes to a school outside of Malden, the city will send the student´s per capita spending—the average amount of money spent—with them to the student’s school. This system of per capita expenses applies to students all over the United States.

Increased funds allow students in those districts to bloom academically without the challenge of a teacher shortage, and even if teachers are unavailable, substitutes can be hired to fill in their places. Hence, learning time will not be taken away and productivity can be enhanced.

Christina Freeman, a student residing in Winchester, informed, “At Winchester High, there are two substitutes. Every time I’ve had an absent teacher, I still get to take my class from my classroom with the help of one of the two subs and continue to complete my course for said class. In fact, there are no TBA classes or directed studies. Each class has a respective teacher hired for it.”

At this point, it seems as if having teachers for classes is a luxury. Yes, there are obstacles standing in our way, but we have been fighting against them for so long without a change that it is time to take additional action. If fellow students around Massachusetts and the rest of the United States can obtain adequate educational resources, so can Maldonians.

Despite this situation, there is one more factor that is just as important as funding: the Fiscal Year. The Fiscal Year is a 12-month accounting period that the City Council of Malden uses for financial and tax reporting purposes, starting on July 1st and ending on June 30th. However, the process of composing the budget begins in winter and is typically finalized by June.

Due to the later finalization, the new teacher hirings are posted later and the applicant pool is much smaller than it could be if the hirings were posted in spring. By summer, a large number of applicants have already found jobs in different districts that post positions earlier, leaving a few still scouring for a teacher opening.

“There’s a smaller pool of folks to hire from…if you don’t have people to interview, if no one’s applying, you can’t hire anybody,” commented Ann O’Connor, the Jenkins Guidance Counselor for 10-12th graders.

“My team and I are working on finding ways to post positions earlier, so that even though the budget is technically not finalized until June, we could have, for example, anticipated vacancies that are posted, for which we can advertise and recruit, so that as soon as the budget is finalized, we can bring on board new staff members in that we have already recruited,” Sippel suggested.

“The short-term solution is to do everything we can with what we have. Moving forward with [Dr. Sippel], we’re going to be able to do that. For the long-term, we must change that formula [Chapter 70],” Mayor Christenson concluded.

If the Fiscal Year can start earlier, or Sippel´s plan is implemented for 2025, Malden may see an increase in applications and thus teachers.

Recommendations For Solutions

Short-Term:

- Prioritize posting hiring positions for teachers between February and April to get a higher and more diverse applicant pool.

- Increase substitute pay to attract more substitute teachers and reduce the time students spend in the Student Study Center (SSC).

- For the next school year, increase the number of electives and hire teachers for these classes, allowing students to broaden their education.

Long-Term:

- Make progress with the percentage of commercial businesses in Malden to raise local receipts.

- Fight to modify Chapter 70 inequities in state government.

- Gradually increase taxes in the city for adequate funds.

For additional information concerning Malden’s budget, visit City Budget | Malden, MA